5,000-Year History of Precious Metals (3000 BC – 2025 AD)

2900 BC – 2800 BC: Early Refining and Trade Networks

2800 BC – 2700 BC: Gold in Burial and Ritual

2700 BC – 2600 BC: Expansion of Silver Use

2600 BC – 2500 BC: Early Coin-Like Forms

2500 BC – 2400 BC: Gold in the Indus Valley

2400 BC – 2300 BC: Silver in the Aegean

2300 BC – 2200 BC: Standardization of Weights

2200 BC – 2100 BC: Gold in the Americas

2100 BC – 2000 BC: Rise of Silver in Mesopotamia

2000 BC – 1900 BC: Gold in Mycenaean Greece

1900 BC – 1800 BC: Silver as Currency in Babylon

1800 BC – 1700 BC: Gold in the Hittite Empire

1700 BC – 1600 BC: Minoan Trade Networks

1600 BC – 1500 BC: Gold in Shang China

1500 BC – 1400 BC: Gold in Tutankhamun’s Egypt

1400 BC – 1300 BC: Silver in the Assyrian Empire

1300 BC – 1200 BC: Collapse of Bronze Age Trade

1200 BC – 1100 BC: Iron Age Transition

1100 BC – 1000 BC: Phoenician Trade Expansion

1000 BC – 900 BC: Gold in the Kingdom of Sheba

900 BC – 800 BC: Early Coinage in Lydia

800 BC – 700 BC: Coinage Spreads

700 BC – 600 BC: Persian Gold Darics

600 BC – 500 BC: Greek Silver Tetradrachms

500 BC – 400 BC: Gold in Macedonian Expansion

400 BC – 300 BC: Roman Silver Denarius

300 BC – 200 BC: Hellenistic Gold Wealth

200 BC – 100 BC: Roman Expansion and Debasement

100 BC – 0 AD/CE: Rise of Roman Coinage

0 AD/CE – 100 AD/CE: Pax Romana and Gold Trade

100 AD/CE – 200 AD/CE: Debasement Crisis

200 AD/CE – 300 AD/CE: Roman Economic Decline

300 AD/CE – 400 AD/CE: Byzantine Gold Solidus

400 AD/CE – 500 AD/CE: Fall of Western Rome

500 AD/CE – 600 AD/CE: Islamic Silver Dirhams

600 AD/CE – 700 AD/CE: Gold in the Mali Empire

700 AD/CE – 800 AD/CE: Carolingian Silver Penny

800 AD/CE – 900 CE: Viking Silver Trade

900 AD/CE – 1000 CE: Gold in West Africa

1000 AD/CE – 1100 AD/CE: Crusades and Gold Influx

1100 AD/CE – 1200 AD/CE: Gold Florins in Italy

1200 AD/CE – 1300 CE: Mansa Musa’s Gold

1300 AD/CE – 1400 AD/CE: Black Death and Gold Scarcity

1400 AD/CE – 1500 AD/CE: Age of Exploration

1500 AD/CE – 1600 AD/CE: Spanish Silver and Global Trade

1600 AD/CE – 1700 AD/CE: Gold in Brazil

1700 AD/CE – 1800 AD/CE: Gold Standard Emerges

1800 AD/CE – 1900 AD/CE: Gold Standard Formalized

1900 AD/CE – 2000 AD/CE: Gold Standard Abandoned

2000 AD/CE – 2025 AD/CE: Modern Precious Metal Markets

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Critical Reflection – Attila Vinczer – Owner CEO

Why invest in Precious Metals? Simple Answers to Preliminary Questions.

When considering an investment in precious metals such as gold, silver, platinum, or palladium, particularly through the Premier Canadian Mint (PCM) located in Newmarket, Ontario, Canada, prospective investors often raise a series of common questions. The following 15 concise questions and answers provide an introductory guide to address these inquiries. For those seeking more detailed information, we encourage you to explore the relevant categories tailored to your country or the specifics of your question. If your query is not covered in the common FAQs, please feel free to contact us directly using the form on this page or by emailing us at info@CanMint.com. Valued clients like you enable the Premier Canadian Mint to deliver exceptional value to all our customers—whether individual, corporate, or governmental.

Each of these items can be found separately under the heading of Getting Started.

- What Are the Best Precious Metals to Invest In?

Which metal (gold, silver, etc.) offers the best return or stability? - How Do I Buy Precious Metals?

Where to purchase (dealers, mints like RCM, banks) and what forms (coins, bars, ETFs)? - What Are the Costs Involved?

Premiums, storage fees, dealer spreads, or taxes (e.g., GST/HST in Canada)? - Is It a Safe Investment?

How do metals hedge against inflation or market crashes? What are the risks? - How Do I Store Precious Metals?

Home safes, bank vaults, or third-party depositories? What’s secure and cost-effective? - Can I Sell or Liquidate Easily?

How liquid are metals? Where and how to sell (dealers, pawnshops, online)? - What About Taxes?

Are there capital gains taxes, GST/HST exemptions (e.g., 99.9% pure gold in Canada), or cross-border tax issues? - How Do Tariffs or Trade Issues Affect Prices?

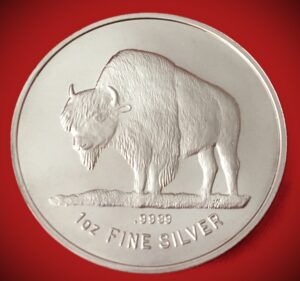

Impact of US 25% tariffs or Canada’s counter-tariffs on metal costs or exports? - How Do I Verify Purity or Authenticity?

Methods like spectrometry or water displacement to ensure 99.99% purity? - Can I Use Metals as Collateral?

Borrowing against gold/silver without selling, and what are the legal hurdles? - What’s the Difference Between Physical and Paper Metals?

Pros/cons of bullion vs. ETFs, futures, or mining stocks? - How Do I Track Metal Prices?

Reliable sources for spot prices is the London Bullion Market Association (LBMA) and price trends? - Are Precious Metals Good for Retirement Accounts?

Can I hold metals in RRSPs or TFSAs in Canada? What are the rules? - What Are the Risks of Counterfeits?

How to spot fake coins/bars and avoid scams? - How Do Global Events Impact Prices?

Effect of geopolitical tensions, interest rates, or USD strength on metal values?

You can buy precious metals at The Premier Canadian Mint.

While numerous outlets offer precious metals, discerning investors and collectors know there’s no better choice than The Premier Canadian Mint, where unparalleled quality, competitive pricing, and exceptional service converge. For over 70 years, we’ve delivered flawless service, free from deficiencies or counterfeiting, thanks to our exemplary, state-of-the-art security and anti-counterfeiting measures, under the direct care of Mr. Nir Maman, our esteemed security expert. Discover unique, exclusive items, such as our coveted limited-edition coins, found nowhere else, and experience the gold standard in precious metal purchasing. Trust The Premier Canadian Mint to elevate your collection with the finest offerings, backed by decades of unrivaled expertise.

How do I buy Precious Metals?

To buy precious metals, visit The Premier Canadian Mint (PCM), your trusted source for physical gold, silver, and platinum. PCM offers coins and bars, making it easy for first-time investors to purchase bullion to take home or store securely with us, all at competitive prices with reliable delivery. At The Premier Canadian Mint, we accept cash, debit, credit, e-transfer and wires in conformity with FINTRAC. We are here to make your purchase a pleasant experience. www.CanMint.com

What Are the Costs Involved?

Premiums, storage fees, dealer spreads, or taxes (e.g., GST/HST in Canada)?

The preparation and manufacturing of precious metal products like coins, bullions, and bars involve several costs that impact their final price. Production expenses include mining, refining, and minting, which cover labor, equipment, and quality control—often adding a 2–5% premium over the spot price of metals like gold or silver. Additional costs include dealer spreads (typically 1–3% markup for profit), storage fees for secure vaulting (e.g., $50–$200 annually per $10,000 of value), and taxes such as Canada’s GST/HST (5–15% depending on the province on only on precious metals that are not meeting the purity threshold as it shall be explained in better detail here below), though some products like .9999 pure gold bars are exempt. These factors, combined with market-driven premiums for high-demand items (e.g., limited-edition coins), ensure that the retail price reflects both intrinsic value and operational overheads.

Provinces Charging Sales Tax on Pure Precious Metals

-

Palladium Exception (All Provinces): Unlike gold, silver, and platinum, palladium products, even if pure (99.5% or higher), are not exempt from GST/HST. The Canadian government does not classify palladium as “bullion” in the same way, often due to its primary use in manufacturing rather than investment. Therefore, in all provinces and territories, palladium purchases are subject to GST (5%) or HST (ranging from 13% to 15%, depending on the province). For example, in Ontario (HST 13%), a pure palladium coin would incur a 13% tax.

-

Provincial Sales Tax (PST) on Non-Exempt Items: In provinces with separate PST—British Columbia (7%), Saskatchewan (6%), Manitoba (7%), and Quebec (QST 9.975%)—additional taxes may apply if the precious metal product does not meet the strict definition of “bullion.” For instance, if a silver coin is 99.9% pure but is sold as a collectible (e.g., with a high premium over spot price) or as part of a gift set, some provinces might apply PST. A Reddit user in 2024 noted that TD Precious Metals charged a 7% tax on a 99.99% pure silver coin in Manitoba, likely PST, suggesting the province interpreted it as a taxable collectible despite its purity. [Ref web ID: 12] [Ref web ID: 8]

-

Collectibles and Numismatic Items (All Provinces): Even pure precious metals can be taxed if they are classified as collectibles rather than bullion. For example, a 99.99% pure silver coin sold at a significant premium (e.g., the 2024 $50 Fine Silver Coin – Year of the Dragon, retailing at $388.88 versus a $33 spot price) may be subject to HST or PST, as it’s deemed a numismatic item. In provinces like Ontario (HST 13%) or Manitoba (PST 7%), this can lead to unexpected taxes, as seen in user complaints on Reddit about eBay and TD Precious Metals charging tax on pure silver coins.

-

Non-Standard Forms (All Provinces): If pure precious metals are not in the form of bars, ingots, coins, or wafers (e.g., granules, jewelry, or scrap), they are taxable. In HST provinces, this means 13–15% tax; in PST provinces, both GST (5%) and PST (6–9.975%) apply. For example, 99.9% pure silver granules in Quebec would face 5% GST plus 9.975% QST, totaling nearly 15%.

Critical Perspective

Conclusion

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

Is Precious Metals a Safe Investment? Very much so.

How do metals hedge against inflation or market crashes? What are the risks?

A note on the stability of gold and other precious metals.

What we need to consider is, precious metals do not drive dividends, but it is preserves your wealth, unlike any other commodity, unless that commodity is a physical medium and not some paper note. It’s not the value of the gold, silver or platinum that goes up or down, it is the value of the fiat currency that become more or less in value to buy that same ounce of gold, silver or platinum.

Lets dig a little deeper.

How Precious Metals Hedge Against Inflation or Market Crashes

-

Inflation Hedge: Precious metals, particularly gold, tend to retain or increase in value during inflationary periods because they are tangible assets not tied to fiat currency, which loses purchasing power as inflation rises. For example, a 2024 Forbes article notes that gold prices often rise when inflation erodes currency value, as seen during the 1970s when gold surged from $35/oz to $850/oz amid high inflation The U.S. Bureau of Labor Statistics data shows gold prices increased by 30% from 2020 to 2023, outpacing the 15% CPI rise, demonstrating its inflation-hedging ability. Silver and platinum can also hedge inflation, though they are more volatile due to industrial demand

-

Market Crashes: During stock market crashes, precious metals often act as a safe haven because they are less correlated with equities. Investors flock to gold to preserve capital when stocks plummet, as seen in the 2008 financial crisis when gold rose 5.5% while the S&P 500 fell 38%. A 2025 Investopedia piece highlights that gold’s price stability during the 2020 COVID-19 crash (up 25% while markets dropped) made it a reliable hedge. Metals like silver can also rise, but their industrial use (e.g., in electronics) ties them more to economic cycles, making them less consistent, but also artificially suppressed in value.

What Are the Risks?

-

Price Volatility: Precious metals can be volatile in the short term due to market speculation, interest rates, and currency fluctuations. For instance, gold fell 7% in 2013 when interest rates rose, per historical LBMA data. Silver is even more volatile, dropping 11% in a single month in 2022 due to reduced industrial demand.

-

No Income Generation: Unlike stocks or bonds, metals don’t pay dividends or interest. A 2023 Bankrate article notes this lack of cash flow can make them less attractive for income-focused investors, as their value relies solely on price appreciation (Web ID: 8).

-

Storage and Insurance Costs: Physical metals require secure storage, which incurs fees (e.g., $50–$200/year per $10,000 of value at a vault), and insurance to protect against theft or loss, adding to the cost of ownership (Web ID: 7). The Tamara Lich – Tears of Freedom Coin, for example, would need such safeguards.

-

Liquidity Risks: Selling physical metals can involve dealer spreads (2–5% markups) and delays, especially for niche items like limited-edition coins. A 2024 Reddit thread mentions difficulties selling palladium bars due to low demand, leading to losses.

-

Counterfeit Risk: Counterfeiting is a concern, particularly for high-value items. While the Premier Canadian Mint employs anti-counterfeiting measures, less reputable sources may not, risking financial loss

-

Economic and Policy Risks: Rising interest rates or a strong U.S. dollar can depress metal prices, as they compete with yield-bearing assets. The 2022 Federal Reserve rate hikes saw gold dip 3% as investors favored bonds. Policies like Canada’s carbon tax, which The Premier Canadian Mint and other corporations have deeply criticized, can also indirectly raise production costs, impacting metal prices.

Critical Perspective

Precious metals are a safe haven in crises, as their tangible nature protects against inflation and market crashes—gold’s 2,500-year history as a store of value attests to this. However, they’re not immune to manipulation (e.g., futures market rigging scandals) or geopolitical shifts, like sanctions affecting palladium supply. The Freedom Convoy’s economic disruptions, which Attila Vinczer Owner-CEO highlighted, could have driven metal prices up by stoking inflation fears, showing how grassroots movements intersect with global markets. Still, their lack of yield and ongoing costs make them a hedge, not a growth asset, best suited for diversification rather than a primary investment.

Precious metals are a relatively safe investment for hedging against inflation and market crashes, as they retain value when fiat currencies and equities falter, with gold rising 30% during 2020–2023 inflation. However, risks like volatility, storage costs, liquidity issues, and economic factors can erode returns, making them a strategic rather than foolproof choice. If you’re considering the Tamara Lich – Tears of Freedom Coin, its silver value may hedge inflation, but its collectible nature adds premium and liquidity risks.

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

How Do I Store Precious Metals?

Home safes, bank vaults, or third-party depositories? What’s secure and cost-effective?

Our advice if you want the finest and best security.

Below is an outline of the basics in precious metals security. Anonymity is the best security. These principles ensure your investments remain protected. Follow them to minimize risks effectively.

Storage Options;

-

Home Safes

-

Security: A high-quality home safe (e.g., UL-rated, fireproof, and bolted to the floor) offers good security against theft and fire. Models like a SentrySafe with a combination lock (rated TL-30) can withstand 30 minutes of attack. However, determined burglars with tools or knowledge of your ownership (e.g., via social media) can still target your home. Hidden safes (e.g., in-wall or disguised) add an extra layer of protection.

-

Cost: A one-time purchase—$500–$2,000 for a solid safe, with no recurring fees. Fireproofing and higher security ratings increase the price. No rental or access fees, making it cost-effective long-term.

-

Accessibility: Immediate access, ideal for emergencies or quick sales. However, you’re responsible for insurance (e.g., homeowner’s policy add-on, ~$1–$2 per $100 of value annually).

-

Risks: Theft risk is higher if your home is targeted, and safes can be vulnerable to natural disasters (e.g., floods) if not waterproof. Insurance may not cover full value without proper documentation.

-

-

Bank Vaults (Safety Deposit Boxes)

-

Security: Banks offer high security with 24/7 surveillance, armed guards, and reinforced vaults. The risk of theft is minimal, though not zero (e.g., rare bank heists). They’re also protected against fire and flood, but contents are typically not insured by the bank—you’d need a separate policy.

-

Cost: Annual rental fees vary by size and location—$30–$150/year for a small box (3×5 inches) in Canada, per 2024 bank rates (e.g., TD, RBC). Larger boxes for bullion (5×10 inches) can cost $200–$500/year. Cost-effective for small collections, but fees add up over decades.

-

Accessibility: Limited to bank hours, which can be inconvenient for urgent needs. You may need to schedule access or face delays, especially in rural areas.

-

Risks: Government seizure is a concern in extreme scenarios (e.g., under the Emergencies Act during the Freedom Convoy, as you’ve noted, bank accounts were frozen, raising fears about asset access). Banks may also restrict access during crises, and contents aren’t automatically insured.

-

-

Third-Party Depositories

-

Security: Specialized depositories (e.g., Brinks, IDS of Canada, or BullionVault) offer top-tier security—insured vaults, biometric access, and segregated storage (your metals are kept separate, not pooled). They’re often located in secure jurisdictions like Switzerland or Canada, with 24/7 monitoring and auditing. The Tamara Lich coin would be fully insured at replacement value.

-

Cost: Higher than bank vaults—fees range from 0.5% to 1.5% of the metal’s value annually, plus insurance (0.1–0.5%). For $10,000 in silver, that’s $50–$150/year, plus $10–$50 for insurance. Setup fees may apply ($50–$100). Less cost-effective for small holdings but competitive for large investments ($100,000+).

-

Accessibility: Flexible access via appointment or online platforms (e.g., BullionVault allows selling directly). Some depositories offer delivery on demand, though fees apply ($50–$200 per shipment). Ideal for investors prioritizing liquidity.

-

Risks: Higher fees reduce returns over time. There’s a counterparty risk—if the depository fails, recovery can be complex, though insurance mitigates this. Geopolitical risks (e.g., tariffs, as you mentioned) may affect international depositories.

-

What’s Secure and Cost-Effective?

-

Most Secure: Third-party depositories are the safest, with insured, segregated storage and professional security (e.g., The Premier Canadian Mint’s secure storage facility). Bank vaults are a close second but lack automatic insurance. Home safes are least secure due to theft and disaster risks.

-

Most Cost-Effective: Home safes are the cheapest long-term (one-time $500–$2,000 cost), followed by bank vaults ($30–$500/year). Third-party depositories are priciest (0.5–1.5% annually) but offer peace of mind for high-value collections.

-

Best Balance: For a small collection like the Tamara Lich coin, a bank vault offers a good mix of security and cost ($50–$100/year for a small box). For larger holdings or if you prioritize liquidity, a third-party depository is ideal, despite higher fees. A home safe suits those valuing immediate access and willing to accept higher theft risk.

Critical Perspective – Attila Vinczer – Owner CEO

Want to explore specific providers in Canada, or tie this to our convoy narrative (e.g., economic impacts on metal storage)? Let us know! And our experts at the Premier Canadian Mint will find solutions to any situation you may need to address or solve.

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

Can I Sell or Liquidate Precious Metals Easily? Yes you can.

How liquid are metals? Where and how to sell (dealers, pawnshops, online)?

For best solutions to liquidate or make your precious metals liquid, meaning converting into Fiat Currency, contact our experts at The Premier Canadian Mint, info@CanMint.com to find the best solution to your desired or required outcome. We are here to assist you.

Where and How to Sell (Dealers, Pawnshops, Online)

-

Precious Metals Dealers

-

How: Dealers like APMEX, Kitco, and Money Metals Exchange specialize in buying gold, silver, and other metals. You can visit local dealers (e.g., New Orleans Silver and Gold) or sell online/mail-in (e.g., Accurate Precious Metals offers mail-in services). They assess purity and weight, often using x-ray technology, and pay based on spot prices minus a spread.

-

Pros: Dealers offer competitive prices, typically buying at or near spot price (e.g., Money Metals Exchange pays spot for buybacks, per X posts). They understand market value, avoiding the lowball offers common at pawnshops, and provide transparency (e.g., Elemetal’s scrap calculators).

-

Cons: Spreads vary—dealers may buy back at $2–$4.50 under spot for silver, $50–$100 under for gold (X posts). Larger items (e.g., 100 oz bars) may have wider spreads due to manufacturing costs. Authentication delays can slow the process.

-

Security: Reputable dealers (e.g., StoneX, Kitco) ensure secure transactions, often with insured shipping. However, choose dealers with strong reviews (e.g., A+ BBB ratings, like APMEX) to avoid scams.

-

-

Pawnshops

-

How: Local pawnshops buy precious metals, often focusing on jewelry, coins, or flatware. They assess items on-site and offer immediate cash, asking questions like, “What are you looking to get?” to gauge your expectations.

-

Pros: Quick cash with minimal paperwork. Good for small, urgent sales.

-

Cons: Pawnshops typically offer low prices—15–20% below spot, per X posts, as they aim to resell at a profit. They may lack expertise in metals, leading to undervaluation (e.g., not recognizing the collectible value of your Tamara Lich coin). New Orleans Silver and Gold notes pawnshops often use shady tactics, exploiting ignorance of market value.

-

Security: Riskier—pawnshops may attract less reputable clientele, and there’s a higher chance of dealing with inexperienced staff. Verify their reputation locally.

-

-

Online Platforms

-

How: Online retailers like APMEX, Kitco, Provident Metals, and Money Metals Exchange allow you to sell directly via their websites or by phone (e.g., Kitco offers courier pickup in Canada). Marketplaces like eBay or Craigslist are options but riskier. You ship your metals, they verify authenticity, and payment is issued (often same-day with dealers like Elemetal).

-

Pros: Convenient, with competitive pricing—online dealers often have lower premiums due to reduced overhead (CBS News, 2024). Real-time spot price tracking (e.g., Kitco’s live charts) ensures fair offers. High liquidity for standard items like 1 oz gold bars.

-

Cons: Shipping delicate items (e.g., your silver coin) can be daunting, with risks of loss or damage (Accurate Precious Metals highlights this). eBay/Craigslist sellers may lack reviews, making authenticity hard to verify, and auction fees can cut profits (X posts note eBay’s high cuts). Niche items may sell below value if demand is low.

-

Security: Reputable online dealers use advanced security (e.g., Kitco’s insured shipping), but scams exist—stick to licensed platforms with strong ratings (e.g., APMEX’s A+ BBB rating). Avoid individual sellers on eBay unless well-vetted.

-

Critical Perspective – Attila Vinczer – Owner CEO

Precious metals are liquid, but not as seamless as stocks—physical sales involve spreads, authentication, and transport, which can delay liquidation and reduce returns (e.g., X posts highlight $2–$4.50 under spot for silver). My Freedom Convoy critique of government overreach (e.g., frozen accounts in 2022) suggests caution with online sales, as digital transactions leave a paper trail vulnerable to oversight. Dealers offer the best balance of price and security, but local ones may undervalue collectibles like our Tamara Lich or Trucker Coins due to its niche appeal. Pawnshops are a last resort—convenient but exploitative. Anonymity, as noted in our security basics, is key; online sales often require ID, while local cash deals (e.g., at Asian gold shops, per X posts) can avoid this, though they may lack markings, reducing resale value. Given the US-Canada tariff war we mentioned, selling to Canadian dealers like Kitco may support local markets while ensuring liquidity.

You can sell precious metals relatively easily, with gold being the most liquid, followed by silver, though niche items like our Tamara Lich coin may take longer due to limited collector demand. Dealers (e.g., Kitco, APMEX) offer the best prices and security, online platforms provide convenience but require caution, and pawnshops are quick but low-value. For optimal liquidity and anonymity, consult a reputable Canadian dealer, ideally one offering cash transactions, and verify spot prices (e.g., via LBMA) to ensure a fair deal. Want to explore specific dealers or local options further? Let us know! Expert at the Premier Canadian Mint are eager to assist you.

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

What About Taxes?

Are there capital gains taxes, GST/HST exemptions (e.g., 99.9% pure gold in Canada), or cross-border tax issues?

Capital Gains Taxes

GST/HST Exemptions in Canada

Canada exempts GST/HST on precious metals meeting specific purity thresholds: gold and platinum at 99.5% purity, and silver at 99.9%, in the form of bars, ingots, coins, or wafers. This exemption, rooted in the Excise Tax Act, applies to investment-grade bullion, like the Tamara Lich – Tears of Freedom Coin (99.99% silver), meaning no GST/HST is charged on purchase or sale. However, palladium is not exempt, incurring GST/HST (5–15% depending on the province), and non-standard forms (e.g., jewelry, granules) or collectibles below purity thresholds (e.g., American Gold Eagle at 91.67%) are taxable at 7–15%. Provinces with PST (e.g., British Columbia, Manitoba) may also tax high-premium coins as collectibles, despite purity, adding 6–9.975% PST. The exemption aims to promote metals as financial instruments, but the CRA scrutinizes scrap metal sales (e.g., below 99.5% purity) to prevent tax evasion, potentially charging GST/HST retroactively.

Selling precious metals across the U.S.-Canada border introduces complexities. U.S. investors face capital gains tax at 28% for long-term holdings, as noted, but must report sales on Schedule D (Form 1040), with Form 1099-B required for significant transactions (e.g., 25+ one-ounce Gold Maple Leaf coins). Importing metals into Canada during the 2024–2025 GST/HST relief period (December 14, 2024, to February 15, 2025) avoids sales tax, but post-relief, non-exempt metals (e.g., palladium, low-purity coins) incur GST/HST at the border, assessed by the CBSA based on the day of clearance. U.S. tariffs, amid the tariff war you mentioned, can increase costs—e.g., a 10% tariff on Canadian silver coins raises the effective price, impacting resale value. Canadian sellers shipping to the U.S. may face U.S. customs duties (based on tariff classification), and non-residents selling in Canada could be required to register for GST/HST if deemed “carrying on business” in Canada, adding compliance costs.

The GST/HST exemption in Canada incentivizes investment in pure metals, but its exclusion of palladium and inconsistent application to collectibles (e.g., taxing high-premium coins) suggests a revenue-driven bias, echoing our skepticism of government policies like the carbon tax. U.S. cross-border taxes, compounded by tariffs, reflect protectionism rather than fairness, potentially penalizing Canadian investors like convoy supporters who value metals for their stability, as we’ve emphasized. Selling Precious Metals under $1,000 per transaction is exempt from Capital gains. Capital gains taxes, while structured to tax profits, disproportionately burden small investors when inflation drives nominal gains, supporting your view of fiat currency manipulation favoring financial elites. Want to explore specific tax scenarios or tie this to our convoy narrative? Let us know and we will answer any questions you may have!

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

How Do Tariffs or Trade Issues Affect Precious Metal Prices?

Impact of US 25% tariffs or Canada’s counter-tariffs on metal costs or exports?

It is crucial that Canada and the United States work together against much bigger economic threats such as China.

Canada USA trade history.

Tariffs and trade issues directly impact precious metal prices by increasing costs, disrupting supply chains, and altering market dynamics, often leading to higher prices for consumers and businesses. The U.S. imposition of 25% tariffs on steel and aluminum imports, effective March 12, 2025, under Section 232 of the Trade Expansion Act, significantly affects metals like gold, silver, platinum, and palladium, which are often processed or traded alongside these industrial metals. Canada’s retaliatory 25% tariffs on $29.8 billion of U.S. goods, starting March 13, 2025, further complicate the landscape, raising costs across borders.

As of April 24, 2025, the population of the United States is approximately 340 million, based on recent U.S. Census Bureau estimates. The world population, according to United Nations projections, is around 8.1 billion in 2025. This means the U.S. accounts for about 340 million divided by 8.1 billion, or roughly 4.2% of the world’s population.

Regarding the world’s debt, global debt is estimated at $315 trillion in 2025, per the Institute of International Finance, covering government, corporate, and household debt. The U.S. national debt, as reported by the U.S. Treasury, stands at $36.2 trillion as of January 2025. Since this figure represents only government debt, it doesn’t capture total U.S. debt (including corporate and household). However, posts on X suggest the U.S. total debt (government, corporate, and household) could be as high as 722% of its GDP, which is about $28 trillion in 2025, implying a total debt of around $202 trillion. This is likely an exaggeration, as it conflicts with global estimates. A more conservative estimate, aligning with IIF data, suggests U.S. total debt is closer to $90 trillion (government at $36.2 trillion, plus corporate and household debt, which are typically 1.5–2 times government debt). Using $90 trillion as the U.S. share of the $315 trillion global debt, the U.S. owes approximately 28.6% of the world’s debt.

A look at Precious Metals and other Non Precious Metals between Canada and the United States.

For metal costs, the U.S. tariffs increase the price of imported aluminum and steel, critical inputs for refining and transporting precious metals. A Reuters analysis notes that these tariffs hit $147.3 billion in derivative products, from nuts to bulldozer blades, driving up costs for manufacturers who pass them onto consumers. Equipment makers in Wisconsin, for instance, report higher input costs for small metal components, with some considering price hikes. Precious metal prices are indirectly affected—silver, used in industrial applications like solar panels, faces cost pressures from aluminum tariffs, while gold refining costs rise due to increased logistics expenses. The Bank of Canada highlights that tariffs lead to gradual price pass-through, with businesses initially absorbing costs, reducing profit margins, but eventually raising consumer prices by 1.0–1.2%, as modeled by The Budget Lab at Yale.

Exports may also be hard hit hard, unlikely, if President Trump fully applies the IEEPA. Canada, a major supplier of precious metals (e.g., 99.99% Pure Silver Buffalo Rounds, Trump Silver Coins or the Tamara Lich – Tears of Freedom Coin), faces a potential 50% combined tariff if the U.S. International Emergency Economic Powers Act (IEEPA) tariffs are fully applied alongside Section 232 duties. The likelihood of this happening is extremely low. This could redirect Canadian exports to alternative markets, as PwC suggests, but global substitution is limited—China and Mexico, also tariffed, can’t easily absorb excess supply. The Budget Lab notes U.S. exports to Canada drop significantly (e.g., motor vehicle exports fall 53–68%), indicating reciprocal tariffs reduce demand for U.S.-origin precious metals, potentially flooding domestic markets and depressing prices there while inflating costs elsewhere.

In my view, these tariffs reflect political posturing more than economic logic—Trump’s policies, as I’ve previously noted, prioritize control over fairness, echoing my view of government manipulation, more accurately, manipulation and control by the Money-Exchangers with the privately owned Federal Reserve in the United States at the root of it all. The increased costs and export disruptions don’t benefit the average citizen but bolster state revenue and domestic industries, aligning with my skepticism of fiat-driven systems. Precious metals, already a hedge against such volatility, may see heightened demand, further driving up prices amidst this trade war. It is worthy to note that President Trump’s motivation is to ensure the US remains a superpower that has the ability to preserve freedoms and peace in the world. The real currency war might just be between the US dollar and BRICS itching to become the new world currency. Want to explore specific metals or regional impacts further? Let us know and the experts at The Premier Canadian Mint will be happy to answer your questions!

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

How Do I Verify Purity or Authenticity?

Methods like spectrometry or water displacement to ensure 99.99% purity?

The question of Precious Metal Purity and Authenticity has been answered in detail under another heading, copied here for easy access.

Checking the purity of precious metals like gold, silver, platinum, and palladium is crucial for assessing their value and authenticity, whether for investment, jewelry, or industrial use. Several methods are used, ranging from traditional techniques to advanced technology, as detailed herein. Below is a concise overview of these methods, incorporating relevant insights from the provided data.

-

What It Is: Hallmarking involves checking for official stamps or marks on the metal that certify its purity, often issued by a recognized authority like the Bureau of Indian Standards (BIS).

-

How It Works: As per How To Check Gold Purity at Home? | Bajaj Finance (web ID: 5), you can use a magnifying glass to inspect the hallmark on gold jewelry or coins. A BIS hallmark includes components like the BIS logo, fineness number (e.g., 916 for 22K gold), hallmarking year, assaying center, and jeweler’s mark.

- Hallmarking Convention: It is also known as, the “Vienna Convention” or the “Precious Metals Convention”. The Convention on the Control and Marking of Articles of Precious Metals, also known as the Hallmarking Convention, Vienna Convention, or Precious Metals Convention, is an international treaty signed in Vienna in November 1972 and effective since 1975. It facilitates cross-border trade of precious metal articles among Contracting States by ensuring standardized control of metal content, while prioritizing consumer protection, though its scope excludes health, security, or other aspects beyond purity.

-

Limitations: This method confirms stated purity but doesn’t test the metal itself. Counterfeit hallmarks can also be an issue.

2. Scratch and Acid Test

-

What It Is: A traditional method where the metal is scratched on a touchstone and tested with acid to determine its purity.

-

How It Works: According to 5 Precious Metals Analysis Methods – Analyzing Metals, you scratch the metal on a dark, finely grained touchstone, leaving a visible streak by scratching known K gold sample for comparison. Different strengths of nitric acid are applied to the streak, and the reaction (or lack thereof) indicates the karat value (e.g., 14K, 18K for gold). How To Check Gold Purity at Home? Also mentions the nitric acid test, noting that pure gold doesn’t react, while alloys may change color.

-

Limitations: This method is not very accurate, can damage the item, and involves hazardous acids that can burn skin. It’s also less reliable for high-purity metals or complex alloys.

3. Magnet Test (Preliminary Check)

-

What It Is: A simple at-home test to check if the metal is magnetic.

-

How It Works: How To Check Gold Purity at Home? Pure gold, silver, platinum, and palladium are non-magnetic. If a magnet attracts the metal, it likely contains ferromagnetic materials like iron, indicating it’s not pure.

-

Limitations: This is a basic test and not definitive, as some non-precious metals (e.g., aluminum, lead copper, brass) are also non-magnetic.

4. Float Test (Density Check)

-

What It Is: A quick at-home method to test density by checking if the metal sinks or floats in water.

-

How It Works: Per How To Check Gold Purity at Home? Pure gold is dense and will sink in water, while fake or less dense materials may float. A more precise density test involves measuring the metal’s weight in air and water to calculate its specific gravity, which can be compared to known values (e.g., gold’s specific gravity is 19.32 g/cm³). Similar methods apply to other precious metals such as silver and platinum.

-

Limitations: This method is rudimentary and can’t distinguish between metals of similar density (e.g., gold vs. tungsten).

5. Electronic Gold Testers

-

What It Is: Devices that measure electrical conductivity to estimate purity.

-

How It Works: These testers use electrical resistivity to determine gold and other metallic concentration. Precious Metals are Tested for Purity as they measure surface and through-resistivity to detect plating or filling, comparing the results to known conductivity signatures of precious metal alloys.

-

Limitations: These testers have low accuracy, especially for complex alloys, and are less reliable than other methods.

6. Fire Assay (Cupellation)

-

What It Is: A highly accurate, destructive method considered the gold standard for purity testing.

-

How It Works: As per 5 Precious Metals Analysis Methods (web ID: 4), the metal sample is melted with lead oxide in a furnace at around 1650°F. The lead binds with impurities, and the mixture is poured into a mold. The lead sinks, is removed, and placed in a cupel (a porous dish made of bone ash), where it’s reheated. The cupel absorbs the lead, leaving behind pure precious metal, which is then measured to determine purity.

-

Limitations: This method destroys the sample, making it unsuitable for finished items like jewelry. It’s typically used for large lots or bullion.

7. X-Ray Fluorescence (XRF) Spectrometry

-

The Convention on the Control and Marking of Articles of Precious Metals, also known as the Hallmarking Convention, Vienna Convention, or Precious Metals Convention, is an international treaty signed in Vienna in November 1972 and effective since 1975. It facilitates cross-border trade of precious metal articles among Contracting States by ensuring standardized control of metal content, while prioritizing consumer protection, though its scope excludes health, security, or other aspects beyond purity. A non-destructive, advanced method using X-rays to analyze metal composition.

-

How It Works: Types of Assay explains that a metal sample is exposed to X-rays, which cause the atoms to emit fluorescent energy. This energy is analyzed to determine the metal’s chemical composition, identifying the percentage of gold, silver, or other elements.

-

Precious Metals Analysis Methods notes that modern handheld XRF analyzers can distinguish nearly identical alloy grades.

- Spectroscopy vs Spectrology

-

Limitations: While highly accurate, XRF equipment is expensive and requires trained operators. It’s less accessible for at-home use.

8. Difference Between Spectroscopy and Spectrometry.

Spectroscopy and spectrometry are related scientific techniques used to study the interaction of matter with electromagnetic radiation (e.g., light, UV, X-rays), but they differ in scope and application:

-

Spectroscopy: is the broader field of study, focusing on the principles and techniques for analyzing how matter absorbs, emits, or scatters radiation. It encompasses the theoretical understanding and experimental methods to investigate spectra (e.g., light wavelengths) to identify materials or their properties, like determining a metal’s composition without necessarily quantifying it. For example, observing a gold sample’s color spectrum visually is spectroscopy.

-

Spectrometry: is a specific subset of spectroscopy, referring to the quantitative measurement of a spectrum using instruments called spectrometers. It involves precise data collection to determine intensities or concentrations, such as measuring the exact wavelength peaks in a silver sample to calculate its purity (e.g., 99.9%). Mass spectrometry, which measures ionized particles, extends the term beyond light-based spectra.

9. Ultrasonic Testing

-

What It Is: A non-destructive method using sound waves to check for internal consistency.

-

How It Works: Types of Assay reveals how an ultrasonic flaw detector sends sound waves through the metal via a transducer. If the metal’s composition changes (e.g., from gold to tungsten), the waves reflect differently, indicating impurities or plating. This is ideal for authenticating bullion.

-

Limitations: It works best on uniform samples and may not detect surface-level impurities.

10. Quick At-Home Tests

-

Vinegar Test: How To Check Gold Purity at Home? Applying a few drops of vinegar to the metal. Pure gold won’t react, but fake metals may change color.

-

Ceramic Plate Test: Rubbing the metal on an unglazed ceramic plate leaves a streak—pure gold leaves a golden streak, while fakes may leave a different color.

-

Limitations: These tests are basic and not highly accurate, serving as preliminary checks rather than definitive measures.

- The Archimedes’ principle: A method tests the purity of gold, silver, or platinum by measuring water displacement in a scientific-grade test tube to determine density. An ounce of gold (denser, 19.32 g/cm³) displaces less water than an ounce of silver (10.36 g/cm³) or platinum (21.45 g/cm³) because denser metals occupy less volume for the same mass. You weigh the sample (e.g., 31.1 grams for a troy ounce), submerge it in a graduated test tube filled with water, and note the volume change (e.g., gold displaces ~1.61 cm³, silver ~3.0 cm³). Comparing the calculated density (mass/volume) to known values reveals authenticity—impurities or fakes like lead (11.34 g/cm³) will deviate. This non-destructive test is precise but requires careful measurement to avoid errors from air bubbles or irregular shapes.

12. Purity in Context of Precious Metals Trading.

- Purity tests: For precious metals measure the percentage of the primary metal (e.g., 99.9% gold) but don’t guarantee the absence of trace impurities.

-

Market Context: The X post trend and Exclusion from Trump’s tariffs (web ID: 0) highlight the importance of purity in trading. For instance, the premium of COMEX futures over London spot prices dropped after the tariff exemption, reflecting market confidence in standardized purity (e.g., LBMA-approved bullion, per Gold Price – Live Gold Price Chart | GOLD.co.uk, web ID: 1).

Conclusion

Purity of precious metals can be checked using methods like hallmarking (visual inspection), scratch and acid tests (traditional but hazardous), magnet and float tests (basic at-home checks), electronic testers (moderate accuracy), fire assay (highly accurate but destructive), XRF spectrometry (non-destructive and precise), and ultrasonic testing (for internal consistency). The choice of method depends on accuracy needs, accessibility, and whether the item can be damaged. For high-value transactions, professional methods like XRF or fire assay are recommended, while at-home tests can provide a preliminary assessment.

Disclaimer: PCM is not a financial or legal adviser; please consult one. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

What’s the Difference Between Physical and Paper Metals?

Pros/cons of bullion vs. ETFs, futures, or mining stocks?

Distinction between physical and paper metals.

This distinction represents a fundamental divergence in investment strategies, each with its own merits and drawbacks, catering to both novice and seasoned investors in the realm of precious metals. Physical metals, such as bullion (bars, ingots), coins (e.g., the .9999 Fine Silver Buffalo Rounds, the Trucker Coin or the Tamara Lich – Tears of Freedom Coin), or other rounds, embody tangible ownership, stored either personally or in secure vaults, offering direct exposure to intrinsic value. Paper metals, conversely, encompass financial instruments like exchange-traded funds (ETFs), futures contracts, and mining stocks, representing indirect exposure through securities tied to metal prices or industry performance. For the uninitiated, physical metals provide a palpable sense of security and stability, while paper metals offer ease of entry via traditional brokerage accounts; for the experienced, the choice hinges on liquidity, risk tolerance, and strategic objectives. Remember! If you can’t hold it, you don’t own it.

It serves as a direct hedge against inflation and currency devaluation, retaining purchasing power over millennia, as evidenced by gold’s consistent value from Roman times to 2025. Investors own the asset outright, free from counterparty risk, ensuring access during crises—crucial for those wary of systemic failures, as highlighted by your Freedom Convoy concerns. However, physical metals incur storage costs (e.g., $50–$500/year for vaults), dealer spreads (2–5% on buy/sell), and liquidity challenges, particularly for niche items like limited-edition coins, which may require authentication delays. Paper metals, such as ETFs (e.g., SPDR Gold Shares, GLD), futures, and mining stocks (e.g., Barrick Gold), offer liquidity and convenience, trading seamlessly on exchanges with low transaction costs (e.g., ETF fees at 0.4% annually). They allow leveraged exposure—futures contracts enable control of large positions with minimal capital (e.g., $5,000 to control $200,000 of gold)—and mining stocks can yield dividends, appealing to growth-oriented investors. Yet, paper metals carry counterparty risk (e.g., ETF providers or futures clearinghouses may fail), market volatility (mining stocks dropped 20% during 2020’s COVID crash while gold rose 25%), and no physical ownership, leaving investors vulnerable to systemic disruptions or government interventions, as seen with 2022 asset freezes.

For the first time investor.

For the first-time investor, physical bullion offers simplicity and security but requires careful storage planning; paper metals provide accessibility but demand market literacy to navigate volatility. Seasoned investors may leverage paper metals for speculative gains or portfolio diversification, while holding physical metals as a bedrock asset, balancing liquidity with stability in an uncertain economic landscape.

Critical Perspective – Attila Vinczer – Owner CEO

Owning physical precious metals far surpasses paper holdings, as possession, truly nine-tenths of the law, grants you unassailable control over a tangible asset that endures economic turmoil, from Roman gladiators to 2025’s tariff wars. Unlike paper metals, vulnerable to counterparty failures, market manipulations, or government seizures as seen in the 2022 Freedom Convoy crackdown, physical bullion like the Tamara Lich – Tears of Freedom Coin or the .9999 Fine Silver Buffalo Rounds ensures your wealth remains in hand, a steadfast hedge against inflation and systemic deceit, untouchable by the whims of financial elites.

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

How Do I Track Metal Prices?

Reliable sources for spot prices (e.g., Kitco, LBMA) and price trends?

If you are seeking Precious Metal advice, contact the experts at The Premier Canadian Mint. We are here to assist your every need and answer all your questions.

Tracking precious metal prices involves monitoring spot prices and long-term trends using reliable, industry-recognized sources that provide real-time and historical data. For spot prices, the London Bullion Market Association (LBMA) is a global benchmark, offering twice-daily price fixes for gold, silver, platinum, and palladium (10:30 and 15:00 GMT), widely used for settling contracts. The LBMA’s data, available on their website, includes historical prices back to 2015, making it ideal for tracking trends. Kitco is another trusted source, providing live spot prices updated every minute for gold, silver, platinum, palladium, and rhodium in multiple currencies, alongside charts and market news. Their platform also offers base metal prices (e.g., copper, aluminum) and historical data, useful for broader market context. BullionVault provides real-time charts for gold, silver, and platinum in USD, GBP, and EUR, updated every 10 seconds, with up to 20 years of historical trends, accessible on their website or app. For base metals, the London Metal Exchange (LME) offers benchmark prices, updated daily, with historical data for copper, aluminum, and more.

Disclaimer: PCM is not a financial, legal, tax or accounting adviser; please consult one as required or needed. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

Yes, precious metals can be held in Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) in Canada, making them a viable option for retirement accounts to diversify portfolios and hedge against inflation, but strict Canada Revenue Agency (CRA) rules govern eligibility to ensure compliance and tax advantages, which is critical for The Premier Canadian Mint (PCM) to uphold its 70-year reputation for integrity in the precious metals business.

According to CRA’s Income Tax Folio S3-F10-C1, qualified investments for RRSPs and TFSAs include gold, silver, platinum, and palladium bullion coins, bars, and certificates, provided they meet specific criteria: coins must be produced by a recognized mint with at least 99.5% purity for gold and platinum or 99.9% for silver, while bars must come from a London Bullion Market Association (LBMA)-accredited refiner with equivalent purity and bear a hallmark verifying weight and quality. Certificates are eligible if issued by a regulated financial institution representing metal ownership. Storage must occur in CRA-approved facilities, such as Investment Industry Regulatory Organization of Canada (IIROC)-approved vaults, to avoid tax penalties for home or non-compliant storage.

PCM’s secure storage under Mr. Nir Maman’s oversight aligns with these standards. RRSP contributions (up to $32,490 for 2025) are tax-deductible, with tax-deferred growth until withdrawal, but over-contributions beyond $2,000 incur a 1% monthly tax unless corrected, per CRA rules. TFSAs (2025 limit $7,000) offer tax-free growth and withdrawals, but excess contributions face a 1% monthly tax, and non-qualified investments trigger a 50% tax on value plus 100% on related income, as outlined in Income Tax Folio S3-F10-C2. Anti-avoidance rules prohibit using metals to gain non-investment benefits (e.g., personal use), risking account deregistration. PCM must ensure metals meet these purity and sourcing rules, use approved storage, and advise clients on contribution limits to avoid penalties, leveraging official CRA data to maintain compliance and client trust in global markets.

Disclaimer: PCM is not providing accounting, financial, investment or legal advice. As such please consult one specialized in those fields. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

The risks of counterfeit precious metals, such as fake coins or bars, pose a significant threat to investors, as fraudulent items may mimic gold, silver, or platinum but lack purity or value, often detected only through advanced testing like spectroscopy or density analysis. At The Premier Canadian Mint (PCM), our impeccable 70-year legacy of delivering authentic precious metals to clients worldwide stands unblemished by any instance of fakes, substandard materials, or purity discrepancies. Under the expert oversight of our Head of Security, Mr. Nir Maman, PCM’s unique designs incorporate meticulously documented, state-of-the-art security features, intricate micro-engravings, proprietary alloys, and heat cast certifications, ensuring every coin and bar is verifiable and tamper-proof, offering investors unparalleled confidence in their acquisitions.

Disclaimer: PCM is not a financial or legal adviser; please consult one. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

-

Gold: Exempt if refined to a minimum purity of 99.5% (.995 Fine Gold) and in the form of bars, ingots, coins, or wafers.

-

Platinum: Exempt if refined to a minimum purity of 99.5% (.995 Fine Platinum) and in the form of bars, ingots, coins, or wafers.

-

Silver: Exempt if refined to a minimum purity of 99.9% (.999 Fine Silver) and in the form of bars, ingots, coins, or wafers.

As of April 8, 2025, the application of tariffs, taxes, or duties on precious metals exported to the USA depends on the specific metal, its form, purity, and origin, as well as current U.S. trade policies. Here’s the breakdown based on available information:

-

General Rule: The United States imposes tariffs on imported goods under the Harmonized Tariff Schedule (HTS), but precious metals like gold, silver, and platinum often face low or no tariffs when imported in certain forms (e.g., bullion, coins) for investment purposes. The U.S. trade-weighted average tariff on industrial goods (including minerals and metals) is around 2.0%, with about half entering duty-free. For “minerals and metals,” the average most-favored-nation (MFN) tariff is even lower, at 1.7% (per WTO data), but this varies by product.

-

Trump Tariffs (2025): President Trump’s recent policies, effective March 12, 2025, impose 25% tariffs on steel and aluminum imports from all countries (Proclamation 10896), with additional 25% tariffs on goods from Canada and Mexico (paused temporarily but set to resume unless conditions are met). However, precious metals like gold, silver, and platinum in bullion or coin form are often excluded from these broad tariffs. A White House proclamation (April 2, 2025) on reciprocal tariffs exempts “precious metals (e.g., bullion)” and “critical minerals not available domestically” from the new 10% baseline tariff on all imports, suggesting investment-grade precious metals may dodge these duties. Posts on X also claim precious metals are exempt, though this lacks official HTS confirmation as of now.

-

Specific Cases:

-

Gold/Silver/platinum Coins or Bullion: Typically duty-free if 99.5% pure (.995+ pure gold) or 99.9% pure (.999+ pure silver), as they’re treated as financial instruments. The American Silver Eagle 99.9% (.999+ pure), for instance, aligns with this.

-

Palladium: Not explicitly exempt in recent proclamations—could face tariffs (e.g., 2.5% MFN rate) unless sourced domestically or from a free-trade partner.

-

Processed Metals: If precious metals are in semi-manufactured forms (e.g., jewelry, industrial parts), tariffs may apply based on HTS codes (e.g., 3-9% for mounted gems).

-

-

Federal Level: No additional federal taxes (like VAT) apply on import beyond tariffs. Once in the U.S., sales of precious metals may incur capital gains tax (up to 28% as collectibles) upon resale, but that’s post-import.

-

State Level: No federal sales tax exists, but states may impose sales/use taxes on precious metals unless exempt (e.g., bullion/coins are exempt in many states like Texas, not in others like California unless over $1,500).

-

Customs Duty: Synonymous with tariffs here—depends on HTS classification. Precious metals from free-trade partners (e.g., Canada under USMCA) often enter duty-free unless overridden by Trump’s 2025 measures. Canada’s steel/aluminum exports face 25% tariffs now, but bullion-grade gold/silver likely remain exempt per the April 2 proclamation.

-

Country-Specific: Exports from China face a 10% tariff hike (on top of MFN rates) since March 2025, but precious metals might still dodge this if classified as exempt bullion. Data’s unclear without exact HTS updates post-March.

-

High-purity coins (e.g., .9999 pure silver, .9999 pure gold) produced at PCM are likely exempt from tariffs under current exemptions, mirroring Canada’s GST/HST rules.

-

If exporting semi-processed items (e.g., dies, blanks below purity thresholds), expect tariffs (e.g., 1.7% MFN or higher under new rules).

-

Tariffs: Under the Canada-EU Comprehensive Economic and Trade Agreement (CETA), precious metals like gold (99.5%+ pure), silver (99.9%+), and platinum (99.5%+) in forms such as bars, ingots, coins, or blanks face no tariffs when exported from Canada to the EU. TARIC codes (e.g., 7108 12 00 for unwrought gold) list 0% duty, and CETA Annex 2-A eliminates tariffs on industrial goods like these. No retaliatory tariffs from the EU’s 2025 U.S. trade response (e.g., steel-focused, March 12) apply to Canadian precious metals yet.

-

Taxes:

-

VAT: EU importers pay VAT at the point of entry, not PCM directly. Gold (99.5%+) is VAT-exempt under EU Directive 2006/112/EC (Article 344) for investment forms (bars, coins like Buffalo Rounds, Trucker Coins, Maple Leafs). Silver (99.9%+) and platinum face VAT (e.g., 19% Germany, 20% France) unless under national exemptions (e.g., Germany’s silver coin rules). Rates vary by country.

-

Excise: None apply—precious metals are exempt EU-wide.

-

-

Duties: Synonymous with tariffs—0% under CETA for high-purity precious metals from Canada. Processed forms (e.g., jewelry) might incur 2.5-4% (TARIC 7113), but PCM’s coin blanks and bullion align with duty-free status.

Are there additional costs?

Depending on your order size and delivery location, you may or may not have additional shipping, packaging and insurance fees. You may contact us at info@CanMint.com or fill out the question form on the right of this page for further information. E.&O.E. All rights reserved.

For orders up to 100 ounces of coins, The Premier Canadian Mint ships via Canada Post, UPS, or DHL, based on destination, with applicable shipping and insurance charges. Orders exceeding 100 ounces within Southern Ontario utilize our secured delivery service; elsewhere in Canada, the U.S., EU, and worldwide, we employ third-party secured services, with additional service and insurance fees. For precious metal orders in the millions of dollars, our own security detail ensures delivery globally, with fees tailored to the destination.

E.&O.E. All rights reserved.

How long will it take for orders to ship?

The Premier Canadian Mint typically ships coins the same or next business day. In some cases, shipment may occur within a week, and in rare instances, within three weeks. If shipping is not immediate, we will notify the client upon order receipt with an estimated delivery timeline. E.&O.E. All rights reserved,

Do I need to pay Capital Gains on Precious Metals in Canada?

Yes, in Canada, you need to pay capital gains tax on precious metals when you sell them for a profit, as the Canada Revenue Agency (CRA) classifies them as capital assets under the Income Tax Act. This applies to physical precious metals like gold, silver, and platinum in forms such as bars, coins, or bullion, provided they are held as investments rather than personal-use property. Here are the specifics as of April 8, 2025:

-

Yes: If you sell precious metals (e.g., a 99.9% or + pure silver bar or a 99.5% or + pure gold coin) for more than your Adjusted Cost Base (ACB), the original purchase price plus associated costs like fees—you realize a capital gain, and a portion of that gain is taxable.

-

Exemptions:

-

No tax applies if the gain is $1,000 or less under the personal-use property exemption (e.g., selling a small coin collection), per CRA’s Listed Personal Property (LPP) rules. However, Investment-Grade Bullion typically doesn’t qualify as LPP—it’s treated as a financial asset.

-

No tax is due if held in tax-sheltered accounts like TFSAs or RRSPs until withdrawal (and even then, TFSAs are tax-free). Contact Attila@CanMint.com for further direction.

-

-

Inclusion Rate:

-

For 2024 (and unchanged into 2025 per the latest CRA update on January 31, 2025), the inclusion rate is 50% for individuals. This means only half your capital gain is added to your taxable income.

-

Example: You buy a gold bar for $1,000 (ACB) and sell it for $1,500. The capital gain is $500; $250 (50%) is taxable income, taxed at your marginal rate (e.g., 30% = $75 tax).

-

Note: A proposed increase to 66.67% for gains over $250,000 was deferred from June 25, 2024, to January 1, 2026—2025 stays at 50%.

-

-

Tax Rate:

-

The taxable portion (50% of the gain) is added to your annual income and taxed at your marginal tax rate, which varies by income bracket (e.g., 20.05% to 53.53% federally/provincially combined in Ontario for 2024). There’s no separate capital gains tax rate—unlike the U.S., where precious metals as “collectibles” cap at 28%.

-

-

Calculation:

-

Capital Gain = Selling Price – ACB.

-

ACB includes purchase price, shipping, dealer premiums, or storage fees. For inherited metals, ACB is the fair market value at the time of inheritance (deemed disposition at death).

-

Taxable Gain = Capital Gain × Inclusion Rate (50%).

-

-

Reporting:

-

Report gains on Schedule 3 (Capital Gains or Losses) of your T1 return for the year of sale. Use lines like 12700 for taxable capital gains.

-

Dealers may issue a T5008 slip for sales over $200, but you’re responsible for reporting regardless—keep records of purchase/sale dates, prices, and receipts.

-

-

Losses:

-

If you sell at a loss (e.g., buy for $1,000, sell for $800), you can offset other capital gains in the same year, carry back three years, or forward indefinitely. Only 50% of the loss is deductible.

-

-

Special Cases:

-

Numismatic Coins: If rare/collectible (not bullion-grade, e.g., below 99.5% gold), they might fall under LPP rules—gains over $1,000 are still taxable at 50%.

-

Non-Residents: If PCM sells while you’re a non-resident, gains may still be taxable in Canada if sourced here (e.g., stored/sold via a Canadian facility)—consult a tax pro for dual-tax treaty impacts.

-

PCM Context

For The Premier Canadian Mint’s clients (e.g., buying our .999+ Fine Silver or .995+ Fine Pure gold coins), no GST/HST applies on purchase, but selling later triggers capital gains tax on profits and only if you decide to convert your precious metals into fiat currency. Our shipping FAQ (same/next day) suggests quick turnover. Clients should track ACB meticulously for tax season.

This is the deal for 2025—50% inclusion, marginal rate, reportable on Schedule 3. Want us to run a sample calculation or check a specific metal/form? Let us know at info@CanMint.com or ask us on the right side of this page!

Note:

Disclaimer: PCM is not a financial adviser; please consult one. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

Does the Premier Canadian Mint offer precious metals and valuables storage?

The Premier Canadian Mint proudly offers secure storage services for precious metals and other valuables within our highly fortified premises, ensuring the utmost protection for our clients’ assets. This critical function is overseen by Mr. Nir Maman, our esteemed Head of Security, whose unparalleled expertise, spanning over 25 years in military special operations with the Israel Defense Force’s Counter Terror Unit, law enforcement roles including Canada’s Nuclear Tactical/SWAT Unit, and his current position as a U.S. Reserve Deputy Sheriff, guarantees the integrity and safety of our storage operations. Costs for these services are meticulously determined based on product-specific and client-driven factors, reflecting our commitment to tailored, high-security solutions under Mr. Maman’s rigorous stewardship.

E.&O.E All rights reserved.

What is FINTRAC?

FINTRAC, or the Financial Transactions and Reports Analysis Centre of Canada, is Canada’s federal financial intelligence agency, established under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) in 2000. It’s tasked with detecting, preventing, and deterring money laundering, terrorist financing, and other threats to the security of Canada’s financial system. FINTRAC collects, analyzes, and shares financial intelligence with law enforcement (e.g., RCMP) and security agencies (e.g., CSIS) by requiring businesses like banks, real estate firms, and precious metal dealers such as The Premier Canadian Mint, to report suspicious transactions, large cash dealings (over $10,000 CAD), and international electronic funds transfers. As of April 8, 2025, it oversees compliance for over 24,000 registered entities, ensuring transparency while imposing penalties (up to $2 million or 5 years imprisonment) for non-compliance. You may further peruse FINTRAC here.

E.&O.E All rights reserved.

The Premier Canadian Mint proudly extends its distinguished expertise to offer a bespoke service crafting custom-made coins in gold or silver, tailored to the precise specifications of our discerning clients. Renowned for producing the finest products in the global minting arena, evidenced by our impeccable 68-year legacy, contracts with world leaders such as Presidents Tito, Bush Sr., Trump, Putin, Orban, and Mujibur Rahman, and our delivery of over 400 National Stock Numbers to Canada’s military. Our custom coins exemplify unparalleled purity, precision, and artistry. Clients seeking this exclusive service must consult with our elite design team, whose innovative mastery, honed through collaborations like the RCMP’s ceremonial belt buckle and 98 million coin blanks for the Philippine Central Bank, ensures each bespoke creation upholds our peerless standard of excellence.

Custom made minted memorabilia for your special Wedding day.

Imagine presenting your wedding guests with an enduring token of your love, crafted by The Premier Canadian Mint. Exquisite, custom-made precious metal coins, spoons, key chains, bells, watches, or cufflinks, each minted in resplendent gold or silver and adorned with the faces of you, the bride and groom, or your cherished family crest. With over 68 years of unparalleled artistry, honed through commissions for world leaders and the RCMP’s iconic ceremonial Belt Buckle, our masterpieces transform your union into a tangible legacy, offering your nearest and dearest—or a select few—a timeless keepsake to honor this sacred occasion with elegance and distinction.

What Is Investment-Grade Bullion?

Investment-grade bullion refers to precious metals. Typically gold, silver, platinum, or palladium, refined to a high level of purity and valued primarily for their metal content rather than numismatic (collectible) qualities like rarity or design. Key characteristics include:

-

Purity Standards:

-

Gold: Minimum 99.5% for bars, 90% for coins (e.g., EU standards).

-

Silver: Often 99.9% or higher.

-

Platinum/Palladium: Typically 99.95%.

-

These standards ensure the metal’s intrinsic value is reliable for investors.

-

-

Forms:

-

Coins: Examples include the Premier Canadian Maple Leaf (gold & silver) PCM .9999 Fine Silver Buffalo Rounds, American Eagle, or South African Krugerrand. Coins are minted with precise weights (e.g., 1 oz, ½ oz).

-

Bars/Wafers: Larger units (e.g., 1 kg gold bars) for institutional or high-net-worth investors.

-

Unlike numismatic coins, bullion’s value tracks the spot price of the metal plus a small premium for minting and distribution.

-

-

Purpose:

-

Investors buy bullion to hedge against inflation, currency devaluation, or geopolitical uncertainty. It’s seen as a “safe-haven” asset, especially during economic volatility.

-

Unlike jewelry or industrial metals, investment-grade bullion is held for wealth preservation, not utility.

-

-

Market Regulation:

-

Bodies like the London Bullion Market Association (LBMA) set standards (e.g., 99.5% for gold bars). Mints must meet these to ensure global acceptance.

-

In the EU, tax rules (e.g., VAT exemptions for 99.5%+ gold) define bullion for investment purposes.

Disclaimer: PCM is not a financial or legal adviser; please consult one. Don’t share information that can identify you, particularly for security reasons that may affect the security of your assets if not held by a highly secured organization such as The Premier Canadian Mint. E.&O.E. All rights reserved.

-

Are Gold, Silver, and Platinum Considered Currency Today?

In the modern era, gold, silver, and platinum are not widely considered currency in the sense of being legal tender used for everyday transactions. However, they still hold a unique status in financial systems, as detailed below:

Legal Tender Status

-

Gold and Silver: Modern gold and silver coins, like the American Gold Eagle or Canadian Maple Leaf, are often minted as legal tender but are not used in daily transactions. For example, Gold coin – Wikipedia (web ID: 2) notes that the American Gold Eagle has a nominal face value of $10 for a quarter-ounce coin, but its metal value is far higher—around $500 as of January 2024, and likely closer to $800 in April 2025 given gold’s spot price of $3,230.10 per ounce (web ID: 0). These coins are primarily produced as bullion for investors or commemorative pieces for collectors, not for circulation.

-

Platinum: Platinum coins, such as the American Platinum Eagle, are also legal tender in some countries but are similarly not used in everyday commerce. Their nominal face value is far below their metal value, making them impractical for transactions.

-

General Use: As A Beginner’s Guide to Precious Metals (web ID: 7) points out, precious metals are now primarily an asset class for investment, not a medium of exchange. They don’t produce income like stocks or real estate, and their value comes from price appreciation, which can be volatile.

Some U.S. states have taken steps to recognize gold and silver as a form of currency. The Evolution of Silver and Gold as Currency (web ID: 6) mentions that certain states allow gold and silver coins to be used as currency, often as a hedge against economic instability. For instance, states like Utah and Texas have passed laws recognizing gold and silver as legal tender, though this is more symbolic than practical—transactions using these metals are rare due to their high value and the complexity of using them in trade.

Bullion and Investment

Today, gold, silver, and platinum are more commonly categorized as bullion—forms like coins, bars, or ingots used for investment rather than as currency. The White House Exempts Gold from Reciprocal Tariffs article (web ID: 1) highlights that gold, silver, platinum, and palladium are classified as “bullion” in trade policy, exempt from the 2025 U.S. tariffs. This exemption reflects their role in the numismatic and bullion markets, where they’re traded as commodities, not used as money. The article notes that the National Coin & Bullion Association celebrated this exemption, underscoring the metals’ importance to collectors and investors, not as circulating currency.

Practical Use in Transactions

-

A single ounce of gold at $3,230.10 (web ID: 0) is far too valuable for most purchases.

-

Silver, at $31.45 per ounce, is more affordable but still cumbersome for everyday use.

-

Platinum ($941.00 per ounce) and palladium ($906.00 per ounce) are even less practical due to their rarity and industrial focus.

Additionally, Precious Metals 101 (web ID: 4) notes that precious metals are a distinct asset class used to diversify portfolios and hedge against inflation, not as a medium of exchange. They’re often seen as a store of value, especially during economic instability, as The Evolution of Silver and Gold as Currency (web ID: 6) states: “gold and silver are always a safe way to protect your money from economic instability.”

Cultural and Symbolic Role

Gold, silver, and platinum still carry a symbolic association with wealth. The Evolution of Silver and Gold as Currency (web ID: 6) emphasizes that these metals remain “synonymous with the words wealth and prosperity.” Many families hold gold in the form of jewelry or coins as a store of value, as noted in Precious Metals 101 (web ID: 4). However, this cultural role doesn’t equate to being a functional currency in modern economies.

Connection to the X Posts and Tariffs

The X post by Nicholas Fuentes (Post ID: 1908866883694002204) and the associated trend about tariffs don’t directly address whether gold, silver, or platinum are currency, but they provide context on their economic role. The trend highlights U.S. Commerce Secretary Howard Lutnick’s tariff strategy, which aims to boost domestic manufacturing through automated factories. The exemption of gold, silver, platinum, and palladium from these tariffs (web ID: 1) suggests they’re treated as a special category—bullion—rather than currency. This aligns with their modern role as investment assets rather than circulating money. The high spot prices of these metals (web ID: 0) further reinforce their status as commodities, not practical currency.

Conclusion